What is paid up capital

Paid up capital represent total agreed amount to invest into company by Shareholder. It also used as indicator how well the company financial status is .

Number of share capital held also represent the total voting right.

How to value share capital ? It is normal to have S$1 for 1 share. And S$1 will be called as nominal value of the shares .

Nominal value can be varied from time to time .

Once the nominal value is paid then we will called it as PAID UP

Paid up also refer as total liabilities amount that shareholder willing to bear.

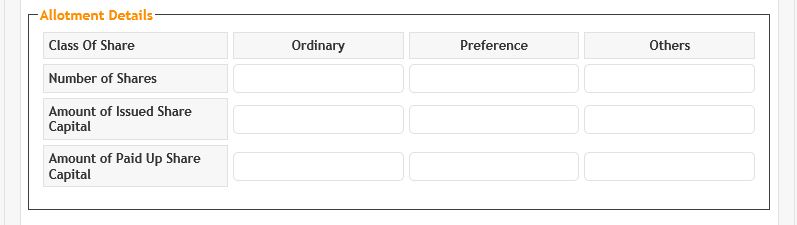

Paid up breakdown need to key in with ACRA as follow :

Paid up can be categories into 3 type

- Fully Paid up

- Payable by otherwise than cash

- Partly paid up

FULLY PAID UP

If director intent to increase share capital to run the company, all existing shareholder should given equal right to the new creation of shares .

If 100,000 new shares was created with S$1 each , total amount of S$100,000 must deposit into company bank account .

TOTAL PAID UP will be S$100,000

PARTLY PAID UP

However there is scenario where is partly paid share, example shareholder allowed to deposit S$50,000 for 100,000 new shares. and the balance amount will be called when it due .

Of course right attached to fully paid up and partly paid up is different, only fully paid up shareholder is eligible to vote .

TOTAL PAID UP will be S$50,000

Issue of partly paid up normally happen on newly setup company. The reason behind is because investor see the growing potential of the company but need time to access the investment fund.

PAYABLE OTHERWISE THAN CASH

This is another popular method to increase shares.

Is normally occur if there is amount ” Company own shareholder ” “declaration of dividend “. Shareholder will offset the amount owned or dividend to re invest into company share capital .