What is Annual General Meeting (AGM)

Received summon about late filing for section 175, 201 and 195 ??

Section 175 refer to Annual General Meeting :

All company must held AGM within 18 months from the date of incorporation OR within 15 months from the last AGM date .

Section 201 refer to Presentation of Report

Audited report or compliance report laid on AGM must not be more than 6 months from AGM due date.

Section 197 – Filing Annual Return (AR)

AR filing must be lodge with ACRA within 1 month from the AGM date

What is AGM ?

Annual General Meeting (AGM) is statutory requirement applied to all Pte Ltd company. It requested to held annually

What is Annual Return Filing (AR)?

Annual Return Filing (AR) refer to transaction we filed Company’s report to ACRA. We only allowed to file AR after held of AGM

Why must have AGM ?

AGM is meeting where shareholder given chance to exceise their right as shareholder .

This is time to judge how well their investment in return, to vote company’s transaction and company vision for next year

When must held AGM ?

Illustration :

Date of Incorporation 2 April 2016

Accounting Year end : 31 March 2017

Reporting Time

Statutory Due Date :S175

Every company must held Annual General Meeting (AGM) to approve financial statement within 18 months from the date of incorporation or within 15 months from the previous AGM.

Due date will be :2 September 2018

Statutory Due date : S201

Account laid on AGM must not be more than 6 months AGM due date.

Due date will be : 30 September 2017

Statutory Due Date : S197

Account must be lodge in within 1 month from the AGM date

Due date will be : 31 October 2017

Procedure to held AGM

A>Physical Meeting of AGM

Physical AGM must be held according to Companies Act.

Proper notice must given to all shareholder . Please refer to the company’s constitution.

A copy of signed report and notice of AGM must mail out to all shareholder registered address.

Is upto shareholder decision whether to attend AGM

B>Paper Meeting of AGM

Paper meeting means all director and shareholder sign on AGM minutes without having physical meeting .

Before we proceed to have paper meeting ,resolution to dispense off hold of AGM must be signed and lodge in with ACRA

Upon received confirmation from ACRA only then we can have paper meeting.

FAQ

a)Can we apply for change in accounting year end ?

Yes

b)What if we late for filing of AR ?

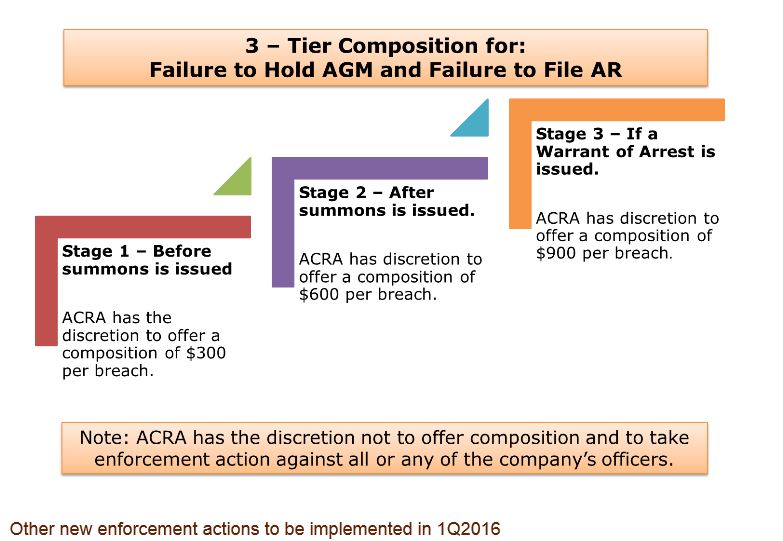

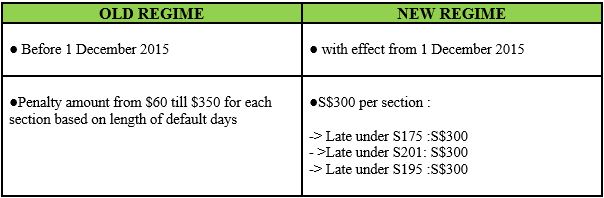

Penalties will be imposed as follow, please click here for more detail

Source information from ACRA website

c) Must all shareholder sign AGM ?

Please refer to the company’s constitution

d) Can shareholder appoint proxy to attend AGM ?

Yes

e) Can we apply extension of time to hold AGM ?

Yes, please click here for extension of time.

f) When must we lodge in with ACRA after held of AGM ?

within 30 days

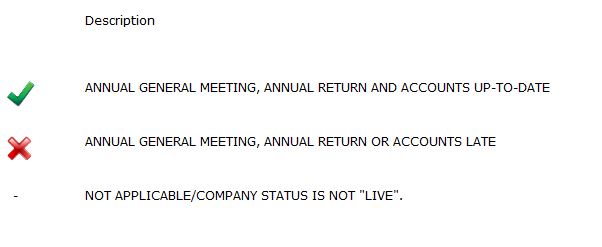

g) what to do with Compliance Rating ?

ACRA will publish the above rating so then public, company’s shareholder , creditor will get up to date information .And this is the key for investor to check Company’s compliance record.

Public always confuse with Tax Return Filing and Annual Return Filing .

- Tax return filing means to file Company account with IRAS every November

- Annual Return Filing means to file Company account with ACRA based on section 175, 201 and 197

Keen to register company or engaged our named company secretary services ? Please contact us at michelle@biztreemgmt.com

.